Charitable Lead Annuity Trust (CLAT)

If you want to place an asset in trust for your children, but don’t personally need or want to draw an annuity from it, you may like the idea of that asset providing an annuity to a charity instead. This is the role of the Charitable Lead Annuity Trust.

In a way, you might think of the CLAT as a charitable GRAT (learn more), with some beneficial twists.

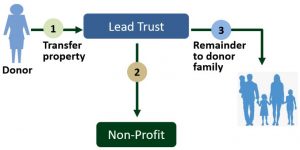

Here’s how the CLAT works. As with a GRAT, you set up a trust and, working with your advisors, decide on the number of years for its term, set up an investment plan, and calibrate the rate at which the trust will pay an annuity stream to your chosen charity. If you plan well and your investments cooperate, at the end of the trust’s term a substantial asset will remain for your children, but without exhausting your lifetime gift tax exclusion.

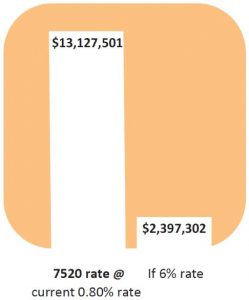

A key to success with this strategy is a low 7520 rate. This is an interest rate set monthly by the IRS and mirrors rates in the commercial marketplace.

This rate matters because the IRS will use it to determine, in the present, the gift tax on the future gift to your children. In doing so, the IRS does not care what level of assets will, in actuality, one day remain for them. Instead, the gift tax is based on a present value calculation of the annuity that will be paid to the charity over time, less a discount factor determined by the 7520 rate. The lower that rate, the lower the discount factor, and therefore the higher the IRS will value the charitable gift. If planning and circumstances allow, that value can be high enough to show a zero-remaining gift to your children. This is sometimes referred to as a “zeroed out” CLAT.

This rate matters because the IRS will use it to determine, in the present, the gift tax on the future gift to your children. In doing so, the IRS does not care what level of assets will, in actuality, one day remain for them. Instead, the gift tax is based on a present value calculation of the annuity that will be paid to the charity over time, less a discount factor determined by the 7520 rate. The lower that rate, the lower the discount factor, and therefore the higher the IRS will value the charitable gift. If planning and circumstances allow, that value can be high enough to show a zero-remaining gift to your children. This is sometimes referred to as a “zeroed out” CLAT.

As of May 2020, this rate is the lowest it has ever been.

Meanwhile, to the degree that the assets are able to outperform the rate at which they are being annuitized as the distribution to charity, the potential exists to leave a tidy sum to your children.

CLATs COME IN TWO FLAVORS:

Grantor, where you get an income tax deduction equal to the present value of the gift to charity. This will often equal the value of the assets contributed, subject to an annual 30% of AGI limitation. However, the income from the trust for its life is taxable to the grantor, including capital gain on any sale of assets contributed to the CLAT.

Benefit – Income tax deduction, assets are shifted out of the estate, tax-free gift to heirs, help charity

Disadvantage – Yearly tax cost

In a nutshell, this is a trade-off between current and future taxation.

Non-Grantor, with no charitable deduction, but income is taxable to the trust, which can deduct the amount on the annuity payment to charity each year. Consequently, usually no tax due.

Benefit – Assets out of the estate, a tax-free gift to heirs, help charity

Disadvantage – No charitable income tax deduction.

EXAMPLE

A mother and father have decided to create a $5 million CLAT to last 25 years. It will pay an annuity to their favorite charity of just under $240,000, and all remaining assets in the trust, when its term ends, will go to their children. Assuming the trust could earn 7% on invested assets, there would be more than $13 million distributable to the children, free of transfer tax. This is because the discounted present value of the total annuity payments to the charity matches the original gift to the trust, thanks to the low 7520 rate. Again, a “zeroed out” CLAT. That ability is the power of this technique. If the 7520 rate had been 6% as opposed to the current 0.80%, in order to achieve the tax-free transfer, the total gifts to charity would have to have been over $390,000 per year and just under $2.4 million would be left to distribute to children.

For illustrative purposes only; not a forecast or promise of investment performance, but an example of the impact of a trust strategy under different interest rate scenarios.

If the idea of “doing well by doing good” appeals to you, this strategy might be just the thing.

If you would like to learn more about CLATs and other techniques that might be applicable to your circumstances, talk to your Fieldpoint Private advisor about a complimentary estate plan review.

© 2025 Fieldpoint Private Trust.