Spousal Limited Access Trust (SLAT)

The Spousal Limited Access Trust (also called a Spousal Lifetime Access Trust) is an irrevocable trust created by one spouse for the benefit of the other, and possibly other family members (typically their children). It provides access to both income and principal during life, and continues for the benefit of children and even grandchildren after death.

The strategy could enable you and your spouse to remove up to $23.16 million from exposure to the 40% federal estate tax and maybe a double-digit state death tax, while, at the same time effectively retaining use of those assets for the current and future benefit of your family.

Here’s how it works. The donor/grantor spouse contributes assets to the SLAT, tax free. With that transfer, they give up their direct property rights in those assets, which are then no longer considered part of the estate. At the same time, the other spouse, and any named family members, become beneficiaries of the trust.

Importantly, the SLAT can be tailored to the specific needs of the individuals named. For example, it could allow only the spouse to access trust assets, in which case children and grandchildren would benefit only after the spouse’s death. Alternatively, it could give all family members the same rights, at all times.

The power of the SLAT was greatly amplified with the doubling of the estate tax exemption in late 2017, to what is, as of 2020, $11.58 million per person. The strategy works best in pairs, when with proper drafting, it is implemented by both spouses. As you will see below, with proper planning the opportunity can be orders of magnitude greater than the numbers themselves would imply, but the window to take advantage is uncertain.

RULES OF THE ROAD

Note that you cannot be a trustee of a SLAT you create, or you risk inclusion of the trust assets in your estate at death, thus defeating the purpose. However, your spouse, as beneficiary, can be a trustee, which allows them to make distributions to themselves.

Certain constraints apply to this, however. The law restricts a spouse from making distributions solely at their own discretion and without limits. Thus, distributions must be limited to an “ascertainable standard.” An example of this would be distributions allowable only for health, education, support and maintenance. The grantor has some latitude to decide what constraints to include.

Moreover, because it is an irrevocable trust, a SLAT’s assets are protected from claims that may be brought by its beneficiary’s creditors, litigious future ex in-laws and the like.

It gets better.

THE DYNASTY SLAT

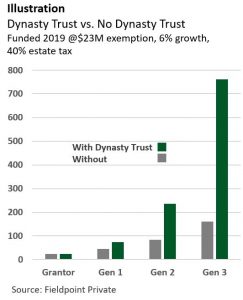

For all the appeal of the SLAT in its basic form, it can be substantially enhanced. By using your generation-skipping transfer tax (GST) exemption, a SLAT can be structured as a “dynasty” trust (learn more). Such a trust can continue into perpetuity, passing from generation to generation, free of estate and GST tax.

See the beneath illustration of this technique, and its wealth-building potential.

AND ALSO CONSIDER

Beyond the SLATs advantages, there are certain risks that you will want to contemplate.

- Divorce If a divorce occurs neither of you is any longer a spouse and assets in the respective trusts would then be for the sole benefit of children or other named beneficiaries. This issue can be partially overcome by drafting the trust for the benefit of “my current spouse,” thus allowing for continued indirect access to the trust through a new husband or wife from at least one of the trusts. Also, the death of a spouse would create these same issues.

- Grantor tax for income tax purposes SLATs are characterized as “grantor” trusts. That means that any income produced by the trust – such as dividends, interest, capital gains – is taxable to the spouse that created the trust. While that is the case, it is important to note that prior to the creation and funding of a SLAT that income had been taxable to the grantor anyway and, moreover, the trust can be drafted to allow for distributions to pay for tax liabilities. On the other hand, this can be viewed as a positive. Paying the tax with outside assets can be seen as a way to make ongoing future gifts to the trust without incurring any gift taxes.

- Reciprocal Trust Doctrine This doctrine is a tax issue that must be considered when SLATs are drafted. In the case of the two-SLAT strategy, it requires that each of the trusts be different enough in their terms so as not to be considered a single unit, and as such effectively canceling each other out. This issue can be overcome with thoughtful document drafting.

As in the investment markets, when opportunities present themselves, they need to be taken advantage of. The opportunity of today’s estate tax exemption is significant, but it could also simply be tomorrow’s “loophole” that concerned politicians demand be closed.

If you would like to learn more about SLATs, and other techniques that may pertain to your wealth transfer objectives, talk to your Fieldpoint Private advisor about a complimentary estate plan review.

About Fieldpoint Private

Fieldpoint Private is a boutique private banking firm established at the onset of the financial crisis by 31 individuals including former Chairmen and CEOs of some of the most well-known and successful financial and consumer firms in America. Their intent was not to craft a firm that would emulate the large, established institutions, but to serve as an alternative. Dedicated to meeting the comprehensive financial needs of highly successful individuals, families, businesses and institutions, Fieldpoint Private offers a powerful combination of private personal and commercial banking services in partnership with our clients’ most trusted advisors. In 2021, Fieldpoint Private founded Fieldpoint Private Trust, increasing the breadth of capabilities available to serve our clients in both sole trustee and co-trustee capacity.

© 2024 Fieldpoint Private. Banking services by Fieldpoint Private Bank & Trust. Member FDIC.

Trust services offered through Fieldpoint Private Trust, LLC, a public trust company chartered in South Dakota by the South Dakota Division of Banking.